5 Resume Hacks

Learning how to write a resume is an art. Here are some tips to hack yours.

How Long?

1 page. Seriously. A resume should get you an interview, not depict your life story. Employers want to be able to see what you’ve done at a glance. When someone is screening through hundreds of resumes a day, nobody wants to flip through anything more than a page. Try it yourself, you’ll see what I mean.

Cross Out The Spelling Bee Award

I’ve reviewed a bunch of resumes, and sometimes I get a kick out of the fact people list irrelevant info like they were President of Student Council etc. Come on guys, lets get real, put down experience that actually matters and pertains to the job you are applying for. Leave the life story for a lunch topic once you get the gig.

Font Selection

Using readable fonts will make the world of a difference. Garamound is an example of a nice serif font that is easy to read. It’s so easy that its the font of choice for Harry Potter.

Summarize That Shit

When you’re describing what you did over a summer internship/old job don’t go into excruciating detail. Future employers just want to get a gist of things. Leave out acronyms and company specific terms too, nobody will understand it, including yourself a few years down the line. Keep descriptions to two sentences maximum.

Ready, Aim, Fire

Bullet points are short and sweet. Use them to your advantage to list a bunch of things if you have to. Remember, less is more.

Does your resume still suck? Contact me if you need help. Fratboy out.

Filed under: jobs | Leave a Comment

Tags: career, gen y, generation y, hacks, jobs, resume, work

How to Save $1,000 This Instant

Ramit Sethi at I Will Teach You To Be Rich has a 30 day challenge, to save $1,000 for the month of November. This is AWESOME, and I am definitely on board.

However, I have a really quick solution to saving $1K this year. It’s not going to take you 30 days. Simply don’t go on vacation this year. Check out my very first video blog below:

I eat my own dog food too. I cancelled my trip to Florida in December.

Filed under: savings | 2 Comments

Tags: economy, finance, investing, personalfinance, saving, stocks

In liu of recent events I thought I’d share my take on the faltering US economy:

$700 Billion Bailout – Great

The government is bailing us out. Yes, even you small business owners who are complaining you didn’t get a $700 billion rescue package. You see, when the big banks can lend it lets you take out more loans to expand/grow your business. When you grow your business people will buy your products. It’s a chain reaction. Stop complaining.

Huge Portfolio Losses – So What

Are you in your twenties or thirties and worried that your portfolio has dropped by 25%? If you haven’t started investing are you worried that “now is not the right time to be buying?” Well you’re wrong. The market won’t be stuck like this forever. Buy as much as you can now so that you can offset your loss in later years. Those who are stressing have a very short-term view, that is not the right approach to investing. Stop complaining.

Real Estate – Bust

The only folks who should be complaining right now are the ones who rode the real-estate train and bought second homes as “investments” on an adjustable rate mortgage or a really bad loan. If you can’t afford it, don’t buy it. I’ve mentioned before how illiquid real estate is, and should be bought for living purposes. I genuinely feel sorry for those who truly lost their homes however. To all the greedy ones, stop complaining.

The Market is Unpredictable

Buy now, buy often. You can quote me on that. The American economy is too strong and too valuable to go under. We have seen and withstood recessions before. The media loves to hype so rage against the machine. Work hard, play hard. Fratboy out.

Filed under: dumb, investing | 1 Comment

Tags: bailout, bofa, citi, dow jones, economics, economy, equities, funds, hedge, investing, mutual funds, rescue package, stock market, stocks, wachovia, wellsfargo

Tax Loss Harvesting For Dummies

Lets face it, the market sucks right now. Chances are some of your stocks/funds are doing really bad. It happens. You can either:

A. Wait and hold on for the ride

B. Sell at a loss (zomg!) and let Uncle Sam help you out

Today we will discuss option B, technically known as tax loss harvesting.

How it Works

- You invested $10,000 in fund A last year

- This year the market takes a 20% decline and you have $8,000 in fund A

- You sell fund A for $8,000 at a $2,000 loss

- You wait 31 days and buy back fund A

- When tax season rolls around, you claim the $2,000 loss. Lets assume you are in the 25% tax bracket. You will get $500 back on your return.

- You invest that $500 in fund A

- Sometime later (maybe next year) fund A picks back up and is worth $12,000.

Not only did you buy and hold but you got $500 out of it too. Let’s not debate the minutiae of tax, I understand there is a capital gains tax for selling your fund etc. the bottom line is you take advantage of your losses. It’s an alternative way of thinking (prevents you from being emotional with your investments) and an excellent strategy if you are buying into solid funds with good fundamentals.

The Caveat

You have to wait 31 days until you can buy back the fund or else it is considered a “wash-sale” and the IRS will get on your ass. There are certain strategies such as buying into a fund that is similar to the original if you can’t stand staying out of the market for a month and a day.

Filed under: investing | Leave a Comment

Tags: harvesting, investing, investing strategies, loss, tax, tax loss harvesting

Don’t Invest Like The Herd

This graph pretty much sums up the behavior of 90% of investors. Select a proper asset allocation, buy and hold. It’s that simple. Leave the I should’ve, could’ve, and would’ve to the sheep.

Filed under: dumb, investing | 1 Comment

Tags: asset allocation, buy and hold, graph, index funds, investing, investor, psychology, stock market

Proof Indexing Wins

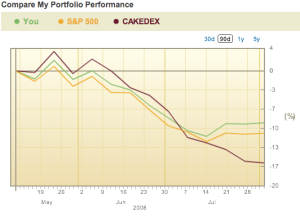

I’ve blogged about tracking my portfolio in Cake. I took a look at my performance this morning and bench marked the Fratboy Portfolio against the S&P500 and the Cakedex, an index of all Cake investors. Check out the results:

Fratboy Investor’s Portfolio: -8%

S&P500: -12%

Cakedex: -16%

What Does This Tell Me?

- The market is doing really bad in general. If your friends are bragging about making 2-bagger they are lying.

- Most of the Cake folks are active investors. Indexing has suffered less this year in comparison.

My advice during these times is to continue investing in index funds. It’s a buyer’s market, when the market rebounds you’ll be in for a nice chunk of change.

Filed under: investing | Leave a Comment

Tags: active investing, Add new tag, buyers market, cake, cakefinancial, indexing, portfolio, swenson

5 Signs You’re An Intern

I’ve paid my dues. I interned at a couple of different companies throughout college. Been there, done that. I’ve identified a couple of ways to avoid looking/acting like the stereotypical intern.

1. Dressing Like a Tool

There are three types of interns. Those who overdress and outdo their manager, those who pretend to be a stylish hipster from Entourage, and those who believe jeans are the be all, end all of all things to come. Try and scope out an intern at your office, you’ll see they will fall into one of these three categories.

2. Volunteering To Coordinate Events

No job screams intern better than planning the companies next team outing. Sucking up to your peers so that you can land another summer of cash next year is just icing on the cake.

3. Over-Complicating Your Actual Job

Interns like to think what they are doing is extremely important and is a deal breaker/life saver for the company they work at. Tasks such as planning the next team outing become superflously described as “coordinating and leveraging resources.”

4. Two Hour Lunch Breaks

Interns love to spend their paychecks on food. They love eating out so much that lunch becomes a full time activity. You can’t get fired for eating lunch for two hours at Hooters because you’re only going to be at the company for the summer. Who cares.

5. Making The Best of Nothing

This is especially true for interns that don’t get paid. The company is so cheap that they somehow convinced you that the experience will pay off more, and that they are doing you a favor by letting you intern for them.

Filed under: jobs | Leave a Comment

Tags: career, intern, internship, jobs, money

I’m on Twitter

For those of you looking for updates on my daily financial musings I’m now on Twitter:

http://twitter.com/syalam

Filed under: Uncategorized | Leave a Comment

Tags: twitter

Recently I blogged about how the iPhone is an investment. Well, there are two sides to a coin so let’s venture to the dark side, the side Apple public relations tries so hard to keep under wraps.

- $199? Forget about it. You pay for activation ($18), data ($30/mo), and if you are the least bit social ($5/mo for 200 text msgs minimum), and did I mention a two year contract with AT&T?

- The 2.0 software is buggy. Your phone will restart a few times a day and applications will crash. Apple will fix this soon however, but for those who just picked one up, you are paying the early adopter tax imposed by his Steveness himself.

- 3G and GPS drain battery big time. Plan on charging your phone every night.

- The casing is made out of plastic. Smudges anyone?

- Despite its shortcomings it is still the most advanced and sleekest phone on the market.

Filed under: stuff | 1 Comment

Tags: apple, att, iphone, iphone 3g, steve jobs, stevejobs